Imagine you are a corporate officer or director sued personally by shareholders for breach of fiduciary duty, following the announcement of a merger transaction. You sleep soundly, believing that the release in the merger agreement fully protects you. Not necessarily!

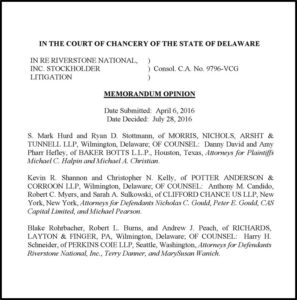

The Court of Chancery of Delaware recently ruled that such a release will not always protect corporate officers and directors from suit. In In re Riverstone National, Inc. Stockholder Litigation, shareholders alleged that the company’s officers and a majority of the directors breached their fiduciary duties by usurping a corporate opportunity.

According to the complaint, the company executed a merger agreement ten days after the shareholders notified the company of the breaches. The merger agreement included a release, in which the acquirer released these claims. The company did not receive any additional consideration for the release. Not surprisingly, the shareholders asserted that no other shareholders benefited from the release, other than the defendant officers and directors. On the same day that the merger agreement was executed, the shareholders filed suit. Three days later, the transaction closed.

Likely feeling confident that the release protected them and that these derivative claims were extinguished by the merger, the officers and directors filed a motion to dismiss. The court swiftly denied the motion to dismiss, ruling that the shareholders could continue with their lawsuit.

Here are a few takeaways from the decision:

- Following a merger, shareholders may bring a lawsuit against corporate officers and directors that is normally derivative in nature, even if the merger eliminated the ability of shareholders to bring a derivative action, if the shareholders plead particularized facts demonstrating a cause of action against the officers and directors.

- Officers and directors may lose the protections of the business judgment rule if they receive a material benefit not shared by other shareholders.

- If officers and directors have a material conflict, courts may evaluate the merger under the more onerous entire fairness doctrine. This means that the officers and directors must demonstrate that the merger was entirely fair to shareholders (a fair price from a fair process). Absent a material conflict, shareholders normally must rebut the business judgment rule and demonstrate a non-exculpated breach of duty.

In his opinion, Vice Chancellor Glasscock offered some consolation to corporate officers and directors. He noted that a court must be wary of conclusory allegations that a merger extinguished a potential derivative suit. Absent particularized facts pled in the complaint. “much ground for strike suits and other mischief would be possible.”

Let’s hope for a lot less of that mischief!